Inflation Nation

For now, inflation makes life uncomfortable, but it’s not so bad as to make dramatic changes in lifestyle necessary.

Some things never change. In Argentina, not only is hyperinflation a fact of life, it has returned to heights unseen in over 30 years.

BUENOS AIRES, Sept 13 (Reuters) - Argentina's annual inflation rate shot up to 124.4% in August and hit its highest level since 1991, stoking a painful cost-of-living crisis in the South American country.

The soaring prices, which rose more than expected, are forcing hard-hit shoppers to run a daily gauntlet to find deals and cheaper options as price hikes leave big differences from one shop to the next, with scattered discounts to lure shoppers.

The August monthly inflation reading of 12.4% - a figure that would be eye-watering even as an annual figure in most countries worldwide - is pushing poverty levels past 40% and stoking anger at the traditional political elite ahead of October elections.

“It’s so hard. Each day things costs a little more, it’s like always racing against the clock, searching and searching,” said Laura Celiz as she shopped for groceries in Tapiales on the outskirts of Buenos Aires. “You buy whatever is cheaper in one place and go to the next place and buy something else.”

It really puts our own inflation problems into perspective, if you live in the United States. Without downplaying our issues, we’re still a far, far cry from anything resembling hyperinflation. The latest Consumer Price Index (CPI) numbers showed prices were up 3.7% year-over-year, so while chronic inflation is here and not going away, we’re not headed for an economic calamity on par with what Argentina is going through, either. If we are, none of us can see it coming. Not a single economic and financial analyst I follow thinks the economy is on the verge of collapse and these are people who are generally skeptical of the official line.

Lyn Alden, one of the best in the game, would never tell you an economic collapse is nigh, but she also shows that inflation is a problem and, contrary to President Joe Biden’s assertions, isn’t over:

Inflation is part of our lives and isn’t going away any time soon. In 10 years, we’re going to look back and be shocked at how much cheaper life was in 2023, difficult as it is to believe at the moment.

Let’s go back to Argentina. One of my favorite prepping commentators, Fabian Ommar, a Brazilian, recently wrote an essay on The Organic Prepper, where he discussed the impact hyperinflation was having on the country:

In the middle of August, large groups invaded and looted supermarkets and stores in the suburbs of the capital Buenos Aires and the provinces of Mendoza, Córdoba, Neuquén, and Río Negro. Though the situation has improved, I’ve been receiving direct reports from Argentinian locals saying attacks are still happening. As I write this post, more than 200 people, including minors, were arrested in more than 150 violent events.

It immediately brings to mind not only our own experience with civil unrest, but also the rampant theft and smash-and-grabs occurring throughout the U.S. today. If it’s happening now, when we’re not experiencing hyperinflation nor a collapsing economy, what do you think would happen as inflation gets worse and the economic environment worsens? Bad as it seems now, the worst is likely yet to come.

More:

The attacks brought back memories of 1989 and 2001 when the economy collapsed, and the population revolted during the governments of former presidents Raul Alfonsín and Fernando De La Rúa. Unlike those instances, though, this time, part of the population mobilized to stop the looters and defend commerce. Images of owners loading firearms and preparing to protect their stores circulated everywhere, too.

It’s safe to say the s**t has once again hit the fan in Argentina. Given prolific gun ownership in the U.S., you can bet Americans have learned the lessons of 2020 and will be prepared for the next SHTF. At least, we can only hope.

However, Ommar does point out that whatever lessons Argentina holds for our country is a matter of perspective:

Most First World residents look at Argentina and see just another Third World sh*thole that seems to never get out of the pit, a banana republic forever struggling with poverty, corruption, and shrouded in populism. That is hard to argue and a common perspective even in many of its neighbors.

However, Argentina is a big country, once the most prosperous and still the third largest economy in South America. Before WW1, its per-capita GDP compared to Germany’s, and Argentina shows marks of that period to this day. For instance, the education level of its population ranks higher than neighboring countries even after decades of erosion and decadence.

The reason I mention that is twofold: 1) Argentina may be a proxy of developed countries as well as of developing or poorer ones, and 2) How things can completely turn upside down and the circumstances change so drastically, given the right (or should I say wrong) conditions.

The events in Argentina are a lesson in “can’t happen anywhere” we so often talk about, and something to keep in mind.

Understand what Ommar is saying: Argentina is, circumstantially, not the same kind of country America is. However, Argentina wasn’t always in a bad place, either. While Argentina’s fate isn’t necessarily America’s fate, we shouldn’t pretend like it could never happen here, either. It’s really more a matter of when, not if.

If we ever do see hyperinflation in the U.S., it’s likely to be “the end” or beyond it. We did experience hyperinflation at the very beginning of this country’s history and during the Civil War, but outside that these two periods, inflation has never been a big problem in America. It’s hard to believe, I know, but these are just the facts. When we have dealt with high (not hyper-) inflation, there was usually a war, specifically a world war, going on. The one exception was the “stagflation” of the 1970s, which saw both high inflation and a decline in the rate of economic growth.

More specifically, hyperinflation is about the month-to-month increase in prices. Even at the worst of summer 2022’s inflation, the month-to-month increase never exceeded 1.2%:

Does any of this surprise you? It shouldn’t. If we were really living with hyperinflation, it’d induce a wholesale change in living habits across all of society.

Going back to the Reuters piece [bold mine]:

The August monthly inflation reading of 12.4% - a figure that would be eye-watering even as an annual figure in most countries worldwide - is pushing poverty levels past 40% and stoking anger at the traditional political elite ahead of October elections.

“It’s so hard. Each day things costs a little more, it’s like always racing against the clock, searching and searching,” said Laura Celiz as she shopped for groceries in Tapiales on the outskirts of Buenos Aires. “You buy whatever is cheaper in one place and go to the next place and buy something else.”

How many of you live like this? I’d venture to guess not many. It’s an inconvenient way to live and most of us would rather not run all over the place looking for the cheapest prices. Of course, we do this with certain things, like gas prices, but when it comes to most other things, we try to get everything in one place instead of itemizing our shopping. For now, inflation makes life uncomfortable, but it’s not so bad as to make dramatic changes in lifestyle necessary. For the most part, we just get on with it, while complaining loudly or quietly about the situation.

I’m not diminishing our situation. I’m just saying inflation is striking us differently and will continue to strike us differently for the foreseeable future. There will be times inflation spikes, like we saw in 2021 and 2022, causing “sticker shock,” but eventually, the shock will wear off and people’s attention will be drawn to other issues. Eventually, a recession will happen, maybe within the next year, but recessions tend to slow inflation or are outright deflationary. So if you want cheaper prices, be careful what you wish for. It comes at a high cost.

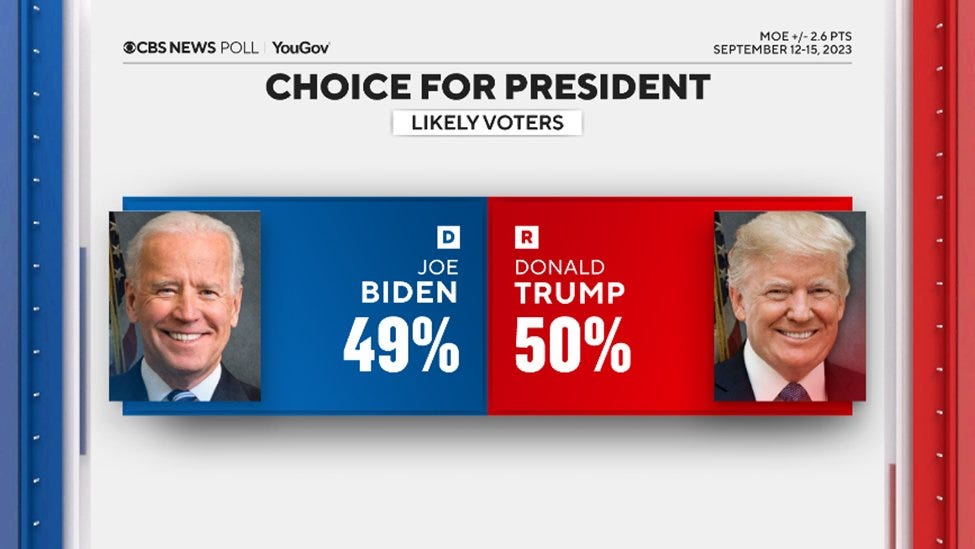

Speaking of the next year, 2024 is an election year. As we saw in 2022, inflation is no longer the political issues it once was. This is because politics in America has become more about identity and culture wars. What this means for the country going forward is a separate issue, but the point is that if you’re expecting Americans to vote against Joe Biden in 2024 because of the performance of the economy, you’re probably in for a disappointing surprise. No, inflation nor a recession can help the incumbent, but it just doesn’t trigger the same kind of backlash it once did.

For example, President Biden’s approval ratings have been consistently hovering around 40%, which, according to conventional wisdom, doesn’t bode well for his re-election prospects. And yet:

Anyway, this blog isn’t about party politics and I’m not much of a political analyst. This is just what I’m seeing and I want to encourage everyone else to trust your eyes. Inflation has become another issue that both sides use as a cudgel against the other. For one side, inflation is Biden’s fault, while for the other, inflation is what happens in the good times, thanks to Biden. Both sides are right and wrong in varying shades, but what I want you to take away from this entry is that inflation will continue to be a problem and will get worse over time. It’s symptomatic of our problems, however, not the cause of them. Even hyperinflation is, ultimately, a byproduct of other issues, namely internal political instability and war. Once it starts, there’s really no stopping it, but it’s also not something that happens out of the blue, either.

What can you do as far as prepping goes? Honestly, not much. We’ve all lived with inflation by now and you know how you’re dealing with it. Hyperinflation is a totally different beast and there isn’t really a way to prepare for it. I suppose you could start living like an Argentine, but I doubt most of you will stick with that lifestyle. It’s difficult to manage and the sort of thing you do out of sheer necessity, not desire. Imagine stopping by four of five different stores to buy all the things you need! Now imagine doing that every day. It’s insane, but in Argentina, you have to do it because prices are going up daily, not monthly.

If you’re really worried about hyperinflation, then the best you can do is to buy what you need now so you’re not priced out later or demand outstrips supply. We all remember how quickly, for example, toilet paper, hand sanitizer, and cleaning products, and bottled water became scarce in 2020. That ought to have been a wake-up call. Think today about what kinds of things you’d need in an SHTF-type situation and start stocking up on these items now. If you start now, there’s no need for bulk-buying - simply build up your stockpile little by little over time. You’d be surprised at how much stuff you can rack up over time. They key is to not find yourself in a situation scrambling to get all that stuff when everyone else is trying to do the same. You’re not going to win that game.

One specific piece of practical advice I can give you is to consider food buckets. From prepper-extraordinaire Daisy Luther of The Organic Prepper:

Let me be clear that I think purchasing healthy whole foods is the very best way to build a food supply. Grabbing shelf-stable options from the store or a supplier is a great way to put back a nutritious stockpile. However, it may not be the fastest way.

If you’re trying to build a food supply quickly, consider ordering buckets with a month’s supply of meals.

Here’s why every prepper should have some emergency food buckets stashed away:

A lot of calories can be condensed into a very small amount of space.

If you have the capacity to boil water during an emergency, a filling meal can be yours.

They add variety and speed to an emergency food supply.

Calorie for calorie, they’re lightweight and easily portable in the event of a bug-out scenario.

They’re professionally packaged to have a 25-year shelf life, so you can get it, stick it in the back of your closet, and forget about it until you need it.

Now, the downside.

If you’re looking for ready-made meals, none of them are going to be completely free of additives. This is impossible because they’re made to last for 25 years, to take up minimal space, to cook up quickly and efficiently, and to taste reasonably good.

If you’re going this route, some compromises must be made. Yes, emergency food buckets contain processed food, but you don’t have to let go of all of your focus on healthful choices.

You may look at the prices of these items and say, “Oh, I can’t afford this.” But you have to remember, this is enough food for an ENTIRE MONTH. At $300, that means you’re spending $10 per day on food that only requires the ability to boil water.

You’ll notice on the list of extras that I recommended a gentle laxative. Some people, when dependent solely upon MREs or dehydrated foods, become constipated. I also recommended a high-quality multivitamin to help ensure you’re getting the nutrition you need.

Remember: these buckets are a one month supply PER PERSON. You will need one bucket for each member of your household for a complete one month supply.

Luther goes on to provide links to her favorite food bucket retailer. I recommend you all read that article and consider spending the money today so you won’t need to spend it later. I understand our circumstances vary and, due to finances, storage space, or both, stocking up on an emergency food supply may not seem practical at the moment. That said, consider what humans need to survive and ask yourself: how many things are really more important than a 30-day food supply in a world where we’re nine missed meals away from anarchy? The only reason why a 30-day food supply seems less like a need and more like a luxury is because we’ve been such a stable society for so long and we are able to meet our needs on-demand.

But forget SHTFs for a moment and focus on more mundane crises. Imagine you just lost your job and you have no more income coming in. It might be a tough sell for your family, but if money is tight, yet you had a 30-day food supply in hand, wouldn’t it keep your kids fed until you find your next job? It might sound ridiculous to some, but it shouldn’t. Emergency supplies of any kind aren’t just for the big-time emergencies. That first aid kit - are you planning only to use it when a civil war breaks out? Of course not. If you or your loved one gets hurt, or you see a fellow citizen in distress, are you really going to withhold assistance because you want to preserve your supplies for that bigger emergency? If the answer is “yes,” you’re either a genuinely crappy person or you’re actually not prepared to handle any kind of emergency. I’ve said in the past that people who aren’t prepared to deal with a personal crisis are likely unprepared to deal with a bigger, societal-level crisis. Preparedness is about stuff, but it’s also more about mindset.

The fact is, we’re more likely to deal with several personal SHTFs than we are with several larger-scale SHTFs during our lifetimes. The larger the scale the SHTF, the less control you’re going to have over it anyway, so you ought to be naturally gravitating towards preparing for your personal SHTFs, since you’ll have more control of the situation. It’ll have the byproduct of preparing you for the larger-scale crisis, whereas it just doesn’t work the other way.

Of course, hyperinflation is a long-term SHTF and not something that’s going to fix itself in a few weeks or even a few months. Inflation in general is a long-term phenomenon lasting years, meaning it’s impact will eventually reach you, no matter how prepared you are. I’m afraid there isn’t a solution for everything, though there are mitigations. This is why all the “doomers” out there need to be careful what they wish for. Again, if hyperinflation happens, it’s likely to be the end and what follows will not be a pleasant society. In some ways, being better-prepared simply makes you a target. If you think envy is a problem today, imagine how much worse it’d become in an environment of high prices and scarcity.

None of us will emerge from it unscathed, but we’ll also adapt to the new reality and learn to live with it. There will be suffering, but no mass die-offs. That comes as a disappointment for some, but that says more about them than it does about anything else. Nobody likes inflation either, but when the alternative is Argentina, where prices go up by over 10% monthly, I don’t know, maybe 10% annually isn’t so bad. I’m not saying we should all just shut up and deal with it - chronic high inflation is also bad and comes with serious repercussions - but we should also keep things in perspective. Long after apathetic and negligent leaders like Joe Biden are gone from power, we’re still going to be dealing with high inflation afterwards. Be angry, make your voice be heard, but also channel that towards becoming less dependent on the Regime and better prepared to weather the storm. That’s really the only way to get back at them.

In the long run, the only way to lower prices is to slow economic growth or shrink the economy. I’m not sure any of us are ready for that day, either - that means mass unemployment, more poverty, and lower wages. On second thought, there’s no big difference between hyperinflation or deflation, is there? So again, be careful what you wish for. One day, a tough decision may need to be made whether to sustain unsustainable growth or to suffer today so we don’t need to suffer tomorrow. If that choice is made, in the long run, our civilization will be better off for it, but don’t forget that it’ll never be a painless process.

Finally, remember that Argentines and people all over the world who are living with hyperinflation still find a way to enjoy life amidst the hardship. According to doomers, even chronic inflation ought to be enough to collapse America or induce a civil war, but this simply hasn’t been the case in most real-world examples.

A former American expatriate who lived in Argentina explained how people survived hyperinflation:

Some have asked us how to survive under an inflation regime like that. Our answers are at best partial and certainly humble, after seeing so many friends go through excruciating financial difficulties. We were mostly at a loss trying to help resolve their problems, which went on for years.

My first observation about inflation survival is that strong family groups best navigated the havoc of hyperinflation in Argentina. Those who truly love you and are interested in your welfare are much better at making sure you don’t starve than any government.

Some people recommend having a hedge in gold or other commodities, but for the majority of working folks such hedges are essentially a wish, not a reality. The best hedge is a close circle of friends and family determined to help.

And:

My greatest recommendation for preparing for hyperinflation is to invest in your mental health. Counseling (while it can be afforded), pastoral help for those of faith, and the conscious cultivation of healthy relationships will all help cushion the blow of economic disaster.

As with so much of preparedness in general, this is kind of advice serves us well during both good times and bad.

How are you dealing with chronic inflation? Do you see hyperinflation as a possibility within our lifetimes? Let’s discuss in the comments section.

Max Remington writes about armed conflict and prepping. Follow him on Twitter at @AgentMax90.

If you liked this post from We're Not At the End, But You Can See It From Here, why not share? If you’re a first-time visitor, please consider subscribing!