Today, we revert to the mean, if only for a moment. That’s because I intend to keep my thoughts on the following topics as brief as possible, though certainly as thought-provoking as possible also.

Let’s get to it.

Another Leftist Economist Bites The Dust

Gary Stevenson, a leftist economist in Britain who’s public profile has recently become magnified, tries to make an argument in favor of taxing the rich:

The thing is, Stevenson’s actually not wrong, not until the very end. The last 70 years have, in fact, not been normal. It was the most exceptional period in world history, when an unprecedented level of prosperity was created for the largest numbers of people ever, coupled with the biggest rise in living standards ever. The world we live in today is the residual effect of the largess built during that time. Stevenson correctly observes that the historical norm is where wealth in a given society is concentrated in the hands of a small elite.

He then follows up his factual analysis with a howler: to improve living standards, to prevent a return to the historical norm, we must tax the rich and use the increased state revenue to provide a higher standard of living for people.

Where have we heard that before?

I’m not going to break down his argument because it’s frankly irrelevant for the most part. We’re talking about fundamentals here. I don’t think anyone here or there likes the rich not paying their taxes, offshoring their wealth, leaving the rest of us to foot the bill for running society. I’m not in favor of any of that. There are many things wrong with our economic order, as I’ve explained many times previously.

However, it’s getting tiring hearing people offer no other solutions beyond, “Tax the rich,” which amounts to “Give the government more money.” There are few things in life that cost a society more than the state. You could argue that a society cannot function without a state, sure, but the state is meant to serve society, not the other way around. Simply giving it more money can never solve our problems, because the state isn’t supposed to be a substitute for economic activity.

Look at it this way: if Stevenson’s premise is true, and it was taxation which created prosperity and higher living standards for Britons, where did the tax revenue come from? This isn’t a chicken-or-the-egg conundrum. If there’s no wealth, there’s nothing to tax. Period. The only alternative then would’ve been to print the money instead, but this would’ve generated massive amounts of inflation, which Britain experienced quite a bit of, actually, post-World War II.

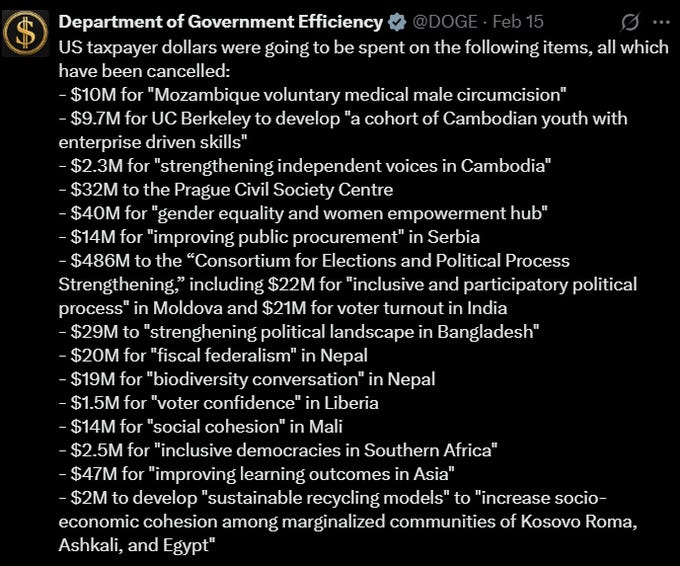

Controversial as it is, one of the reasons I’m so supportive of the DOGE initiative in the United States is because it’s really the first time the public at-large gets to see not only how much money the federal government spends, but how limited the impact of their spending really is, to say nothing of the tremendous waste involved.

Take a look at what DOGE has already uncovered:

Always be skeptical, never take their word for any of this. But if it’s true, and I’ve yet to see anything to show that it’s not, ask yourself: how does any of this help Americans? If you need to come up with some convoluted explanation for how it helps us, it probably doesn’t.

The point is that it doesn’t matter how much money the government gets. If they spend it on things like voter turnout in India, then the government shouldn’t get another cent, or if you’re in Britain, another pence. This isn’t a difficult concept to follow. Once the state takes our money, we don’t get to dictate how it gets spent. Most of money ends up going towards keeping employees paid and the government offices running, anyway.

What’s most concerning is this: raising taxes on the wealthy is something you do when a country can no longer create prosperity. It’s not something which happens in the good times. People being creatures of incentive, nobody’s going to work as hard if that means more money is going to be taken from them. When the rich, who drive much economic activity in society, decide to spend less overall so they can cover taxes, there won’t be as much prosperity to tax. The belief you can raise taxes and productivity will remain unaffected is so fantastical, only a leftist could come up with it.

That all said, I’m of the mind at this point that we should just go ahead and tax the rich. Do it however it can be done. Some times, the only way to debunk a bad idea isn’t to use facts or good argumentation, but to just try it out and fail in the process. Would it really work out that way, though?

Once raising taxes on the wealthy fails to generate desired returns, they’re going to call for even higher tax rates, or find other things to levy taxes on (consider this absurd “luxury car” tax in the UK). When that doesn’t work, when the state is on the verge of insolvency, they’ll do what they’ve always done throughout history: print the money, at the risk of uncontrollable inflation, the cruelest tax of all. If printing the money isn’t an option, then forcible seizure of assets and wealth comes next. You don’t really believe the state is just going to throw in the towel, do you?

The fact is, the state collects taxes because that’s how they survive. When the state feels secure in their power, when it benefits them to do so, they’ll share the spoils with the people, if for no other reason than to keep everyone fat and happy. The more the state feels insecure in power, the more important taxation becomes, because that’s the one way short of blunt force the state can control the populace.

Leftists hate hearing it, probably because it’s true: the problem with socialism is that you eventually run out of everyone else’s money.

That’s what Stevenson is and not in pejorative sense, either:

Morality aside, we shouldn’t tax wealth because the only reason to do so is to give the state complete supremacy over our lives. If they can control our wealth, then not only do we have no meaningful freedom, we may as well all stay poor and take only what the government allows us to have. And no, we don’t get to have a say in what we get to have - that’s the whole point of socialism, actually.

Still not convinced? Another X account asked Stevenson a question he never got an answer to:

Gary, a hypothetical question: if a billionaire’s wealth is entirely tied up in shares of their own company, would taxing them mean they’d have to sell some of those shares to cover the tax bill, thereby reducing their ownership in the company?

Well, duh. The whole idea of Marxism is dispossession, putting everything in the hands of the “collective,” a.k.a. the state.

Let’s not fall for the calls for socialism and “wealth re-distribution” on the notion that “capitalism has failed.” If we do, let’s not act so surprised when the results turn out bad.

Waste Will Continue Until Morale Improves

Speaking of DOGE, the Left is having trouble coming up with excuses for why there’s so much waste, so little return on investment for all this government spending:

He’s right - the government isn’t a business. The government cannot create wealth. And what cannot create wealth shouldn’t have so much access to a country’s prosperity. I’m glad we all agree on that.

A reason why it’s difficult to take the Left seriously is because it’s often so unclear what they’re trying to say. Are they arguing that because the government isn’t a business, we should tolerate the bottomless waste, undelivered promises, and tyranny? That we should give them even more money? What exactly is the argument? Why such defensiveness at any attempt to rein in government spending, greater transparency, and accountability?

One more point: the account above says that the government’s bottom line isn’t profit margins, it’s people. Could that explain why no other entity has been responsible for more bloodshed and carnage than government?

Again, what’s the point here? Or is there one?

Borrowing Has Costs

Far-left activist and aspiring economist Nina Turner says:

Overdraft fees were created in 1990.

Abolish them. We can live without them.

Sure. Let’s understand the consequences of doing so, however.

Investopedia has a great summary of what overdraft is:

An overdraft occurs when there isn't enough money in an account to cover a transaction or withdrawal, but the bank allows the transaction anyway. Essentially, it's an extension of credit from the financial institution that is granted when an account reaches zero.

The overdraft allows the account holder to continue withdrawing money even when the account has no funds in it or has insufficient funds to cover the amount of the withdrawal.

As well as why overdraft fees exist:

An overdraft is a loan provided by a bank that allows a customer to pay for bills and other expenses when the account reaches zero. For a fee, the bank provides a loan to the client in the event of an unexpected charge or insufficient account balance. Typically, these accounts will charge a one-time funds fee and interest on the outstanding balance.

Summary: overdrafting is what allows people to continue paying bills or make emergency expenditures despite not having money. We’ve all heard horror stories about mounting overdraft fees, but the alternative is to not be able to make needed payments and purchases at all.

Do banks really need to charge overdraft fees, though? Why not just charge interest and leave it there, as with any other loan? The problem with overdrafting is that the money literally isn’t there. This is the opposite of the case in most loans, which are given with an expectation that the money is there, just not all of it at once. Overdraft fees are basically a way for banks to protect themselves, in case the loan cannot be paid back.

That said, if you’re poor and you overdraft often enough, the fees end up becoming yet another debt. It’s unfortunate and I’m sensitive to the fact that it can dig an even bigger hole for people, especially with the loan itself needing to be paid back. But having others pay your expenses has its consequences and something like that can never come for free.

At the same time, if you end up driving people into debt through interest and fees, then what’s the point, anyway? Well, what’s the alternative? Why not just let people overdraft at will, with no strings attached? Nina Turner would totally agree to that, no? How’s that meaningfully different from letting people have things for free? The system may be imperfect, it may be meant to serve a different kind of society than we are, but if we let people spend money they don’t have without any kind of cost, then that’s really what would be most pointless of all.

I’m afraid there’s no real solution to this. We just need fewer poor people in this country, but that can only come through greater prosperity. That and getting our population down to a more manageable size. Abolishing overdraft fees doesn’t make paying off debt any easier. Absolving people of their financial burdens seems merciful until you realize someone else is always paying for it. When the government gets involved, then all of us, poor people included, pay for it, either through increased taxation or money printing.

A respondent to Turner’s tweet said:

My mom worked at a bank in the 1980s. If a customer overdrafted with multiple checks, one of her jobs was to decide which was most important to clear (usually utilities) and then contact the customer personally to get funds to clear the rest.

No fees because we used to care more about people than profits.

Assuming it’s an accurate recounting, I can guarantee this was either a local or regional bank, not a national one like Bank of America or Wells Fargo. It’s also an artifact of a much older era, predating the 1980s, from when America was more culturally homogeneous and societal relations were more trust-driven, if only out of necessity. It doesn’t work in today’s multicultural world with a population our size.

The Enemy Needs No Defense

X account “Angelica Reed” posted her spin on an old saw:

“First they came for the communists, and I did not speak out because I was not a communist.

Then they came for the socialists, and I did not speak out because I was not a socialist.

Then they came for the trade unionists, and I did not speak out because I was not a trade unionist.

Then they came for the Jews, and I did not speak out because I was not a Jew.

Then they came for me and there was no one left to speak for me.”

I don’t know if she knows, but, once in power, the communists and socialists came for everyone who wasn’t communist or socialist. As for the others, I think history shows that nobody really speaks out for others. Everyone looks out for their own group first. Speaking for others isn’t even a Western value. It’s specifically an Anglo value, one which has been ruthlessly exploited. Anglo liberals are the only people in the world who speak out more for groups other than their own and all its done is place our societies under relentless assault.

So excuse me if I’m not interested in speaking out for communists, socialists, or any other group whose first act once in power is to destroy anyone who disagrees with them. Who in their right mind defends the rights of such people? Leave that to the lawyers; they get paid to do that and we all know the Left has lots of money.

Also:

In the West, the leftist-Islamist coalition is more of a European phenomenon, but it still exists in the U.S. in spades. Should the Islamists ever rise to power in the West, you can expect the leftists who helped them get there to be promptly swept aside, which is what happened in every case.

It’s not just that the Left doesn’t understand economics. It also doesn’t understand its allies.

People, Not Taxes, Make A Society Worthwhile

An X account which generally gets it right said:

In better times, this message might have more resonance, but not now, not during the Fourth Turning. “i/o” is suggesting that correlation equals causation: since highly-functional societies have high tax-paying compliance rates, it means paying taxes makes for a better society.

Obviously, you cannot run a society without some form of taxation. You cannot run a society without police, either. Yet there are countries all over the world with tremendous amounts of police - think Brazil - which are nonetheless some of the most violent countries on the planet. Does that mean they should have less police? No, but it does mean that having police doesn’t mean your society is going to be safe. It only means your society is going to be worse off without police. It’s the same thing with taxation - ensuring the government has an uninterrupted line of revenue doesn’t mean you’re going to have a functional society. It just means you cannot have a functional society at all without taxation.

Whether police or taxes, what makes a society functional or dysfunctional is the quality of it’s people - human capital. Institutions and services are often a reflection of the kind of people who not only run them, but created them in the first place. Today’s institutional rot is a reflection of the kind of society we’ve become. Expecting institutions like the state to correct social problems isn’t only like expecting a drunk to lead other drunks to sobriety. It’s also how you end up with tyranny, or worse, totalitarianism.

Finally, the state can only collect taxes as long as the people allow themselves to be taxed. People, not money, are what make a society worthwhile. Consider a place like Monaco - it’s population is immensely wealthy and there’s no income tax. It may not be a place for everyone and most of could never aspire to live in such a place. Yet not a single person on the planet in their right mind wouldn’t say that Monaco isn’t a nice place to live, or that it’s a lower-functioning society than, say, America or Britain. We’re always being told there are much better places to live in than the two places on the planet everyone seems to want to live in.

Let’s talk about it - what do you think of Gary Stevenson’s proposals? Is he bringing anything new to the discussion? Or is he just another in a long line of socialists who want access to the wealth of others? Why is there so much resistance to any attempt at bringing government spending under control? What are your thoughts on anything else we’ve discussed?

Money talks, so let’s discuss it in the comments section.

Max Remington writes about armed conflict and prepping. Follow him on Twitter at @AgentMax90.

If you liked this post from We're Not At the End, But You Can See It From Here, why not share? If you’re a first-time visitor, please consider subscribing!

I've never met a person who kvetched about overdraft fees that was actually struggling to make ends meet, it's always people who have zero financial literacy and don't seem to understand the concept of a loan. I'm far from the most financially savvy individual myself but it astounds me the sheer amount of blindness around even the most basic aspects of banking, credit cards, so on and so forth I see more and more not just in the youngest age cohort but my own.

According to ChatGPT, UK government spending is 44% of GDP and taxes are 38%. In Canada spending is 40% and taxes are 34%. But my top marginal tax rate is above 50%, and then there are countless taxes on top of that. I don’t think there’s much left to give.

I think we’ve reached the era of predatory taxation where governments are just grabbing whatever they can to try to stay afloat. Strikingly I get very little for your taxation. The streets aren’t clean or safe, my kids don’t even get textbooks at school anymore and healthcare is indifferent. We’re basically supporting the elderly, foreign welfare scroungers, bureaucracy and corporate welfare.

I think DOGE’s findings are overblown and it’s just publicizing what any educated person already knew. But what I think is striking is how much white collar work is essentially artificial and propped up by government spending: academia, media, consulting, etc.

It’s also important to note that these goofy foreign aid projects don’t actually benefit the countries they ostensibly are meant to benefit. Everything goes to Western firms, academics, etc. That accounts for Zelensky’s point that he had never seen most of the money supposedly sent to Ukraine. Entirely true - very little cash was sent over, especially from the USA.