The Math Doesn't Work Out

When push comes to shove, America will do what any fading regime will do in a desperate attempt to stay afloat: print the money.

Ain’t it good to be on your own?

Ain’t it fun? You can’t count on no one

Ain’t it good to be on your own?

Ain’t it fun? You can’t count on no one

Ain’t it fun?

Living in the real world.

-“Ain’t It Fun” by Paramore.

Right-wing political commentator Jesse Kelly stirred up a hornet’s nest the other day. Here’s the tweet that kicked it off:

He later responded to the fusillade of criticism with this:

Kelly’s commentary drew derision from across the spectrum, but some of the fiercest criticism came from the Right. I think it proves what even rock legend Billy Corgan (of Smashing Pumpkins fame) once said about Social Security: it’s the “third rail” of politics. You don’t touch it, ever.

That said, is Kelly wrong? I often point out we call people cruel for merely pointing out the obvious. That’s all he did here. The math simply doesn’t work out. The largest expenditures when it comes to public spending are Medicare/Medicaid and Social Security. Not defense spending. Cutting defense spending might improve social services on the margins, but nowhere close to making a difference across the board. We can argue social programs are the most worthwhile expenditure, but that doesn’t mean they’ll never go away. Nothing in life is untouchable, nothing in life is guaranteed. You can only have what you pay for. Sometimes, you don’t even get what you paid for.

The U.S. can only get away with racking up the obscene amount of debt it does because the American dollar is the world’s reserve currency. As long as it remains so, it acts as a hedge against runaway inflation, because the world bases their currencies against ours. If we were any other country, not only would we not be able to rack up this kind of debt, but if we found a way to do so, life would be far more uncomfortable than it is already.

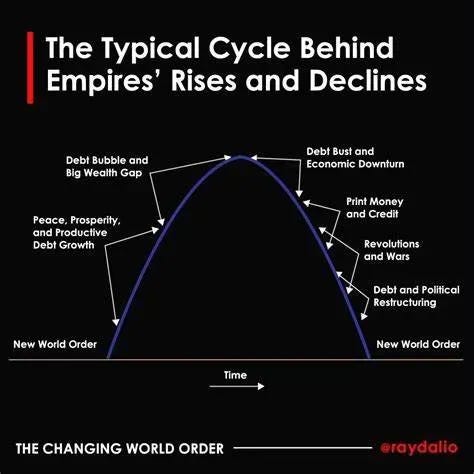

Long-term, the single most consistent threat to a civilization’s viability is money, or lack thereof. Consider investor Ray Dalio’s empire lifecycle - it’s only a model, it’s not perfect, but history demonstrates all societies follow a similar pattern:

If this isn’t a causal relationship, it’s at least a correlative one. For the U.S. to continue to be viable or at least endure the inevitable decline without great tumult, it’s going to need to figure out the debt situation. Blaming Jesse Kelly for his heartlessness is absolutely not going to get it done.

But don’t take it from a right-wing commentator. Let’s hear it from a financial analyst and one of the best at it, Lyn Alden. From February 2022, it’s still one of the best essays on the topic of national debt I’ve ever read and likely will read.

She explains, in great detail, why the U.S. is basically screwed with respect to its debt:

Is this fixable? Well, not really. Suppose the US were to raise revenue such that it takes in 20% taxes as a percentage of GDP, while cutting spending to 18% of GDP. The federal government would be running a 2% of GDP surplus, to try to reign in the national debt.

The vast majority of government spending is mandatory via past legislation, referring to Social Security and Medicare, as well as things like the military/veteran spending. All of that is politically unpopular to cut. The rest of the budget is a small fraction of the total budget. Some of those big items would need to be cut significantly to get to a budget surplus or even breakeven.

Often, a problem is that austerity is used out of order, in a way that is perceived as unfair. For example, during the subprime mortgage crisis, the troubled asset relief program and other fiscal measures bailed out the banker class more thoroughly than the homeowner class in the US. If austerity is attempted after that sort of decision, then the public perception rarely goes over well. People are like, “Oh, so we bailed out the bankers, but when the real economy needs help too, we don’t get it? That’s when we get fiscally responsible?” It’s a good recipe for rising populism.

But suppose policymakers get through that problem and implement fiscal austerity with debt already this high. With a 2% of GDP fiscal surplus out of $25 trillion in annual GDP, the government would be pulling in $500 billion per year in budget surpluses. With $32.5 trillion in debt, that would be a debt/income ratio of 65x, which is still terrible.

Again, Jesse Kelly is correct: the debt situation is fatal. However, he’s not correct when suggesting that cuts could save this country. I think Lyn Alden does a good job of explaining why the debt situation is so out of control that there’s no way for the U.S. to recover from it, even with spending cuts and raising taxes (a strategy known as “austerity”)

So what comes next? Alden has an answer for that [bold mine]:

On the other hand, when the debt is denominated in their own currency, the government almost always ends up printing the difference, holding interest rates below the prevailing inflation rate, and using capital controls or other restrictions to corral market participants into devaluing assets. The result is that bondholders and cash savers lose a big chunk of their purchasing power despite technically getting paid back. It’s a “soft” default, via inflation and financial repression.

When push comes to shove, America will do what any fading regime will do in a desperate attempt to stay afloat: print the money. If you think we’ve printed lots of cash in the last few years, you have no clue how much more we can still print. Though it’s not a cost-free move - extremely costly for the people, in fact - it’s also the most rational move a regime on the brink could make. Really, if the choice came down to hyperinflation with the possibility of forestalling collapse versus doing nothing and enduring collapse, which would you pick? Regimes have chosen one over the other consistently for a reason, even if it seems like a brain-dead choice in retrospect. There just isn’t an alternative.

Back to Dalio’s empire lifecycle (it’s that good). Notice what follows “print money and credit”:

So if we don’t print money, does that mean revolutions and wars don’t occur? No, these things can still happen, regardless. However, these events are also more likely to be delayed if a regime attempts to print its way out of fiscal trouble. Yes, inflation will grow hot and there will be plenty of anger and instability, but as long as the economy continues to function, regimes can buy time for themselves. One day, the consequences will become unavoidable, especially if something like hyperinflation happens, but if there’s anything politicians specialize at it, it’s finding ways to kick the can down the road so it becomes someone else’s problem.

None of this should be taken to mean the U.S. in on the verge of a debt crisis. My personal feeling is that the debt will become a much bigger deal after next year, due to the ending of superpowerdom for America. You have these secular historical cycles posited by scholars like Peter Turchin who provide strong evidence the U.S. endures an existential crisis every 70 to 80 years. Next year, 80 years will have elapsed since the end of World War II. We’re right in the middle of the danger zone. So while we shouldn’t expect the debt bubble to burst this year or the next, the risk of it occurring will rise dramatically post-2025, within the next five to 10 years. But again, this is conjectural on my part.

Is There Really Nothing To Be Done?

Let’s assume the U.S. will face a debt crisis, which it will, sooner or later. Are there alternatives besides austerity and printing the money? There are, but they’re all bad.

“Money Unshackled,” an investment-focused YouTube channel, put up a blog post in January 2021 discussing the various ways the state can address a debt crisis. Much of it is United Kingdom-specific (Money Unshackled is from Britain), but the same principles can apply to the U.S. also. Though we discussed austerity and money-printing, we’ll include their takes on these as well for the sake of thoroughness.

Let’s begin with austerity:

#1 – Austerity

[British Prime Minister David] Cameron and [Chancellor of the Echequer] Osborne tried this in 2010 after the Recession, with limited effect.

The problem with austerity is that it is deflationary and discourages growth at the same time as the debt crisis is already doing both of those things.

It does help reduce debt, but it lowers incomes too, so can be counterproductive.

I think Lyn Alden also did a great job of explaining why austerity is bad policy, so we don’t need to talk about it any further.

This is something that’s becoming more of a thing as of late:

#2 – Debt Cancellations

Just cancelling the debt is not great, as the lenders lose out and this reinforces a downward spiral of deflation, but the crisis can be so severe that it might be sometimes necessary.

It’s widely believed that this needs to happen to solve the Greek debt crisis in the Eurozone, ongoing since 2009.

President Joe Biden recently canceled student loan debt, a move he made against a Supreme Court ruling, but since Biden is a proven authoritarian and rule of law isn’t a thing anymore, you can expect this sort of thing to become more common in the future. It seems like a nice thing to do, but as explained above, if you do it enough times, it’ll become difficult to borrow money, stunting economic growth. Banks are often the most common lenders of money and credit; large-scale debt forgiveness may not only force banks to lend less money or reel in credit lines, it could even trigger a banking crisis. Deflation - the decrease in the cost of goods and services - might sound nice, but remember that falling prices correlates with economic contraction, not growth. If prices fall, it’s typically because fewer people are buying goods and services. That’s a bad thing.

Forgiving debts is useful only as a short-term measure. In 2005, $40 billion in debt held by African countries was forgiven by the world in hopes of spurring development and growth; almost 20 years later, the situation in Africa hasn’t improved much, if at all. The same thing will occur at the micro-level. Erasing debt doesn’t address the reason why that debt was accumulated or why it couldn’t be paid back in the first place.

Large-scale debt forgiveness is likely a last-ditch option, only in the case of a country like Greece, as mentioned above, with a truly fatal debt situation. It makes sense only when the economic state of a country is so bad, there’s no use in trying to get people to pay back their debts and a “hard” reset is necessary. I think the U.S. is quite a distance away from such a condition.

Here’s something that’s been talked about constantly these last few years:

#3 – Slash Interest Rates

Slashing rates makes it easier for people to pay the interest on their debts, at the same time discouraging people from hoarding their money in a bank savings account.

In this way it encourages investment into the economy again.

The Federal Reserve has held interest rates at ridiculously low levels since the 2008 financial crisis. If inflation continues to be a problem going forward, which I anticipate it will, then interest rates will need to be raised often in an attempt to control the rate of change. At the same time, interest rates will need be lowered just as often to keep up the spending to generate economic growth.

Aside from hyperinflation, I see no scenario where interest rates are set more or less permanently at high rates.

Here’s the most likely outcome, as I explained earlier:

#4 – The Magic Money Tree

The central bank just prints more money.

This only works if the country’s debts are in their own currency, but it does encourage growth and spending in the economy which really does help get things moving again.

But is this storing up a currency problem for a later day?

As long as America’s debts remain in its own currency and the dollar remains the world’s reserve, there’s no reason not to use the money printer. When you get right down to it, “Bidenomics” is just that: printing money and the government spending it. Based on GDP numbers and the stock market, the economy seems to be killing it, but the fact that we’re relying more and more on printing money and government spending should be a concerning sign of where exactly we are in the empire lifecycle.

The only other thing to add regarding money printing is this: if you think the Regime won’t do it over the risk of out-of-control inflation, you don’t know history very well.

The final alternative is also something of third rail in politics [bold mine]:

#5 – Raise Taxes

Raising taxes may be necessary eventually to pay for the country’s debts. But raising taxes whilst in a crisis is a big mistake.

This makes everyone poorer at a time when you need money to flow freely again.

The tax hike doesn’t even help the less-well-off, as the money is not being invested to help people, but wasted on debt payments.

However, this is the inevitable final destination for a country in ever rising net debt.

I’m not sure about “inevitable.” I suppose it depends not only on how bad the debt crisis gets, but what form the debt crisis takes. I also don’t know how you’re going to raise taxes when people have no money. The alternative is to simply raise taxes on the rich, who’ll likely threaten the political fortunes of politicians. Of course, “tax the rich” is a sentiment made out of spite, not economic understanding. The amount of debt plus interest would outstrip the wealth of our richest several times over. And what happens when you run out of their money?

I regard raising taxes in a debt crisis the same as forgiving debt: it’s a last-ditch option, something that happens when the Regime and the populace have fallen out of favor with each other and are now eyeing what the other has. Once the populace, including the wealthy, have been stripped of their wealth, what follows is something quite ugly. Take two wild guesses as to what that might be.

By the time a country enters a debt crisis, it’s pretty much stuck there until a civil war/revolution occurs and a new political order is established. A country can remain stuck in a debt crisis for generations (see Greece) and manage to remain viable; the onset of a debt crisis rarely means societal collapse followed by “Mad Max” is nigh, though an economic and political collapse most certainly is. We’re still too early in the game to speculate how long the U.S. could last in the event of a debt crisis.

For now, it suffices to say: when that debt bubble finally does burst, you can mark that moment as the end of the good times. It most certainly won’t be business as usual beyond that point.

Back to Money Unshackled:

Remember that each short-term debt cycle leaves the country a little more indebted than it was before, and after many short-term cycles the problem adds up to result in a mega crash like the Great Depression in 1929.

Many of the levers that were pulled by central banks to resolve the last several short-term crises become less effective each time.

After the 2008 recession, we lowered interest rates to almost zero. Even a decade later, rates have not recovered, so that lever cannot now be pulled again.

Again, much of this is talking about the UK, but the U.S. walked a similar path following 2008, especially when it comes to interest rates. The state is having to do more and more to keep the economy going, but when the next debt crisis strikes, what more can they do that they haven’t already done? Set negative interest rates in an attempt to keep people spending money at all costs?

Right or wrong, there’s a reason why so many financial analysts believe the next debt crisis will be the big one. If nothing else, the timing works out.

Condemning The Future To Their Fate

Though there’s not much we can do about the calamities to come, the last thing we should be doing is taking pleasure in the pain of those who’ll bear their brunt of the consequences. Unfortunately, that’s what many are choosing to do.

A TikTok video recently went viral, featuring a young woman complaining about having trouble making ends meet, despite being a college graduate and being employed. You can find the link to the video in the hyperlink labeled “Source” below the screencap:

From what I saw, responses were mostly sympathetic But then you also had a lot of responses like this:

“Law of Self Defense” is the X account of Andrew Branca, a self-defense attorney and someone I respect. It’s a disappointing to see him react so flippantly, so unempathetically towards this young woman. Branca, who either is or is close to the age of 60, is part of the Boomer generation; many have noted the Boomer generation has become completely oblivious to the plight of younger Americans, maybe even completely detached from the fact that the socioeconomic they grew up and thrived under has passed us by, never to return.

Never mind that for now. I don’t know what this young woman’s politics are. Yes, I’m firm in my belief that we should never give away free stuff, including necessities like health care, without first establishing an orderly society where trusting others to do the right thing is a reasonable expectation to hold. But this isn’t about that.

This is about someone who did it the “right” way: graduated college, makes a living in a respectable manner, and still can’t get by. This is a problem. Millions of people not being able to get by is a time-tested means of destabilizing a society. I don’t see how gloating in the plight of others is an appropriate response to this. It suggests people like Branca have no clue the danger America really is in. Folks like him may at least be able to enjoy the benefits of Medicare and Social Security. There’s a not-insignificant chance Millennials like me, along with younger people like the woman in the TikTok video, will be forced to forgo it, as Jesse Kelly predicts.

I also like to think we have a responsibility to make life more livable for future generations. Isn’t that the objective of civilization? Yet “Boomers” like Branca seem to believe the objective is to make life as intolerable as possible for future generations. Yes, today’s young people are spoiled in many ways. They’re decadent and take civilization for granted. They do feel entitled to the good life, often unwilling to make even the most basic, most sensible of sacrifices. There’s no doubt people like the young woman in the video have a lot to learn, expectations they need to adjust. But making things even more difficult for them, reveling in their discomfort, this isn’t going to teach them anything beyond resentment. Resentment towards their elders, their society, towards the very concept of stability. If this is what the good times look like, what does it mean to talk about how much worse things could be?

Then you had responses like these:

To which our friend, “South Patch Lyds,” replied:

There was also this. It’s very true that affordable homes are now either located in neighborhoods no sensible person should want to live in or in bedroom communities and exurbs far removed from gainful employment:

Nobody, especially young women, should be living in dangerous neighborhoods. And one of the great tragedies of American life going back decades is the long commute. I know it’s not necessarily unprecedented throughout the world, but long commutes were never a good thing. Just imagine how much life we’ve all wasted driving long distances, sitting in suffocating traffic. We’re not meant to spend four hours a day just getting to and from our place to employment. It’s a life-killer. I’m sure it’s a contributor, if not a cause, for many of our health problems, specifically diabetes and heart disease.

Of course, we can all wish for better, but there’s no light at the end of the tunnel. Actually, there is, but it’s an approaching train. The fact is, it’s just too late. I devoted an entire essay to this topic, but our economy passed the point of no return ages ago. There’s just not enough to go around and there will be even less to go around in the future. Meanwhile, the Regime continues to do everything in its power to make the situation worse, such as importing millions of poor people in the insane belief that if even one of them manages to achieve the American Dream, it was worth exacerbating the destabilization of society. Likewise, creating a world where men and women were forced to compete with each other economically turned out to be a decision with destabilizing consequences. But again, it’s too late. The genie cannot be put back into the bottle.

By the time Millennials are as old as the Boomers of today, we’ll be living in a whole different economic reality. Zoomers and Generation Alpha will have it far worse. It’s not their fault - these are the consequences of choices made long before even their parents were born - and nobody should give them a hard time for pointing out the obvious. They’ll never have what the Boomers and Generation X had and they’ll be lucky to have what the Millennials had. If there’s nothing we can do about it, the last thing we should be doing is antagonizing them. We should acknowledge their plight and prepare them for the rough future to come. That’s a role elders should play in society: prepare the youth for hardship. Many of our elders are failing on that front.

Looking over it, this post is a tale of two examples of how many of us can’t handle it when someone tells the truth. When Jesse Kelly says social spending will need to be cut or even outright denied to those who paid into it, they call him heartless. But is he wrong about the financial situation we face? When a young woman in tears gets on social media to talk about how she can’t make ends meet, they call her a fool who deserves what she gets. But again, is she wrong about what the real world is like today?

I’ll close with something I said in the essay “Zoomer Discontent:”

People, especially young people, are reacting as they are because something isn’t right and they can see it all around them. The platforms that were meant to distract them from reality have, ironically, turned into the only way for them to tell the world the truth.

Ain’t It Fun… Living In The Real World?

So is Jesse Kelly right - are we going to need to make cuts to social spending? Or is he just a heartless SOB? Is Max Remington correct - the Regime will print the money, at the risk of hyperinflation, to at least buy time and forestall collapse? Or am I the one who doesn’t understand history? What about the young woman in the TikTok video? Is her story indicative of reality? Or is this a case of poor life choices?

Let’s hear it from you.

Max Remington writes about armed conflict and prepping. Follow him on Twitter at @AgentMax90.

If you liked this post from We're Not At the End, But You Can See It From Here, why not share? If you’re a first-time visitor, please consider subscribing!

So what are we to make of the hundreds of billions the US is giving out in foreign aid to countries that don’t matter to us? I understand your point, it’s reality, but how can they spend a penny on illegals or Ukraine or Israel when Americans are getting the shaft? That’s what will start the violence. Great article.

Over the next two decades 90+% of the Boomers will shuffle off this mortal coil. That will relieve a lot of the current pressure on the Social Security/ Medicare side. Can the current regime muddle along using a variety of One Wierd Economic Tricks long enough for the current bubble of geezers to pop? I guess we'll see.

One thing that I believe will become apparent as the Boomers expire is how frivolous much of their generation will prove to have been. Given the place in time that they were born into and the financial opportunities they were presented, I'm afraid that far too many of their heirs will still be inheriting nothing but their debts. There's still going to be a massive wealth transfer coming from the last of the Silents and all of the Boomers between now and the early 2040s to Gen X and the Millenials, due to the massive number of geezers waiting to croak, but I'm afraid it's not going to be as much as it should have been.

As a GenXer, I think it is imperative for us and the Millenials to not repeat that mistake with our Zoomer and Alpha offspring. No matter the reasons, be they institutional or personal, it is going to be nearly impossible for our kids to buy their own homes without our help. They're probably going to need our help and support quite a bit just making ends meet for awhile, even after they get their first "real" job.

To quote one of the greatest philosophers of our time, drug kingpin Marlo Stanfield from HBO's The Wire, You (Boomers and others dumping on the youth) want it to be one way, but it's the OTHER way. Why is the financial situation screwed for our kids? Don't know. Doesn't matter. Don't care. It just IS. It's our responsibility to help them through it and make sure we leave them with more than the Silents and Boomers will be leaving us.